Domestic sales of excavators in June increased year-on-year again.

Is it a comprehensive recovery or a flash in the pan?

20.7.2024

Source from China Construction Machinery Trading Network

In 2016, three months before his passing, economist Zhou Jintao predicted the economic trough for 2019 using the Kondratiev wave theory. However, the unexpected pandemic delayed the recovery by three years. Now, as the engine restarts and society continues to tremble, the economy has entered an era of increasing uncertainty. In this complex environment, is the construction machinery industry following the ups and downs of the economic cycle or using its own strength to break through the fog and bring a glimmer of light to the era? By retracing the clues, we can see the foreshadowing behind the sales data.

01. Is it an economic recovery or a favorable policy?

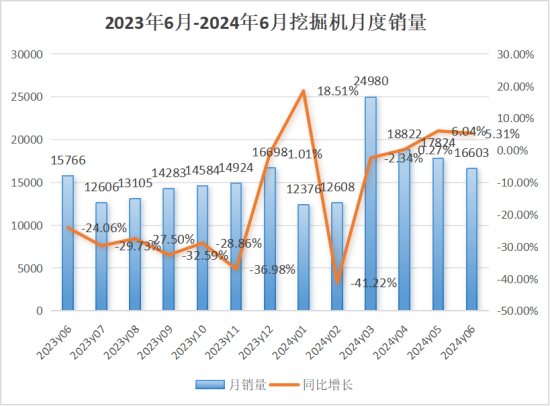

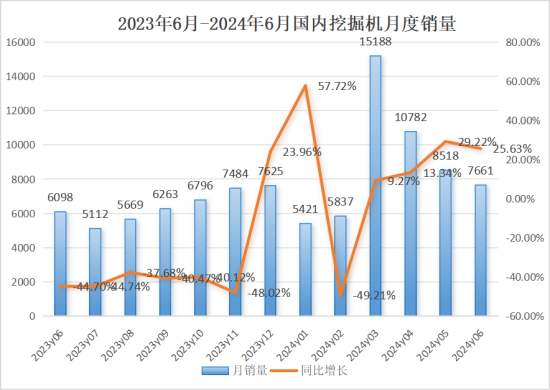

In general perception, the construction machinery industry belongs to a strong cyclical industry. According to the latest data, in June 2024, sales of various types of excavators reached 16603 units, a year-on-year increase of 5.31% and a month on month decrease of 6.85%. Although it continues to grow year-on-year, it is still at a low level in recent years. Focusing on the domestic market again, the domestic sales of various excavators in June were 7661 units, a year-on-year increase of up to 25.6%, but a month on month decrease of 10.06%.

Once the sales figures were made public, various media outlets expressed their opinions one after another. Some were confident in the market recovery, while others cautiously examined each growth point, comparing horizontally and vertically to find its logic from the simple rise and fall. However, fundamentally speaking, it is difficult to separate the dynamics of the construction machinery industry from macroeconomic and policy discussions.

From the perspective of excavator sales in recent years, 2020 was a hot year for the excavator market. Based on data analysis from the same month alone, the domestic sales volume in June 2020 reached 24625 units, setting a new high in recent years. This phenomenon is certainly related to the new replacement cycle of excavators, but economic and policy related factors also have a profound impact. At that time, the country implemented an active fiscal policy, actively expanded effective investment in infrastructure, and strengthened investment in traditional and new infrastructure.

But when looking back at this year, after the gradual relaxation of epidemic prevention and control policies, the originally predicted “retaliatory consumption” of residents still did not come as scheduled, and instead ushered in the “most difficult year for employment” – according to data released by the National Bureau of Statistics, the number of new job opportunities in the first quarter of this year decreased by about 15% compared to the same period last year, with college students being particularly affected, with the proportion of graduates becoming unemployed reaching 8.3%, the highest level in nearly a decade. This is only a small microcosm of the current domestic economic situation. From the perspective of infrastructure related policies, by 2024, 12 provinces including Tianjin, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Guangxi, Chongqing, Guizhou, Yunnan, Gansu, Qinghai, and Ningxia will be required to strictly control new government investment projects. Projects with a total investment completion rate below 50% will generally be delayed or suspended. Projects with a total investment exceeding 50% but significant problems will not be allowed to continue construction. The situation remains tense, and the economic cycle has not caught a breath. The construction machinery industry, which is caught in the wheels, is also unlikely to be an exception. Therefore, it is relatively difficult to expect the construction machinery industry to fully recover in today’s economy.

However, if we turn to a micro perspective, although the sales of excavators in June this year were not as high as in 2020, 2021, and 2022, they are still at a historical high, which is also driven by policies. Since the State Council issued the “Action Plan for Promoting Large scale Equipment Renewal and Consumer Goods Trade in” in March this year, the implementation details of large-scale equipment renewal policies in various regions have been promulgated and implemented, which greatly accelerates the clearance speed of old construction machinery stock equipment and stimulates the demand for some new machinery renewal markets.

Therefore, judging from the current growth trend of excavators, it is somewhat arbitrary to believe that they symbolize economic recovery.

02. Export sales need to find new breakthroughs

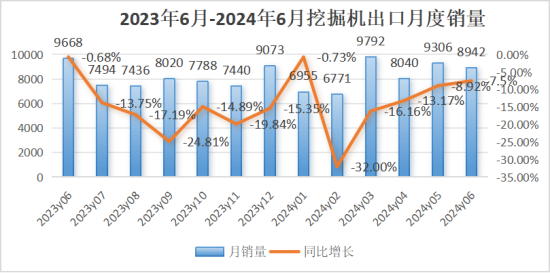

In June, 8942 excavators were exported, a year-on-year decrease of 7.51% and a month on month decrease of 3.91%. Although this number is not as high as June 2023, it is still at a relatively high historical level.

And this relatively high level is the residual warmth of infrastructure policies in Southeast Asia in the early years. According to the “the Belt and Road” National Infrastructure Development Index Report (2021), three years ago, the demand for infrastructure construction in Southeast Asia was strong and the development momentum was strong. The head of construction machinery industry operations at Alibaba International Station predicted in 2022 that the export growth of excavators would maintain high growth in the next two to three years, and “infrastructure funds in the Middle East and Southeast Asia have already been invested.” However, this is indeed the case. With the layout of major domestic leading enterprises and the continuous demand of Southeast Asian countries, excavator export data remains stable.

However, the international situation is not as cyclical as the domestic economy. According to the June data, this slight decrease is related to the relatively strict admission mechanism and regional conflicts in the European and American markets. Our construction machinery brand’s channel coverage in the European and American markets is not deep enough, and the financial policy support it has received is also relatively small. Of course, the strength of local brands in Europe and America should not be underestimated, and it is still difficult for domestic excavators to compete head-on with them in the local market. But the profits in overseas markets are relatively high, and if domestic enterprises actively break through, it will bring new growth points to the industry.

Overall, the fluctuations in excavator sales are a direct reflection of the intertwined effects of the economic environment and policy guidance. In the tortuous path of macroeconomic recovery, policies have become a key force driving the industry forward.